Wallet Max

www.getwalletmax.com

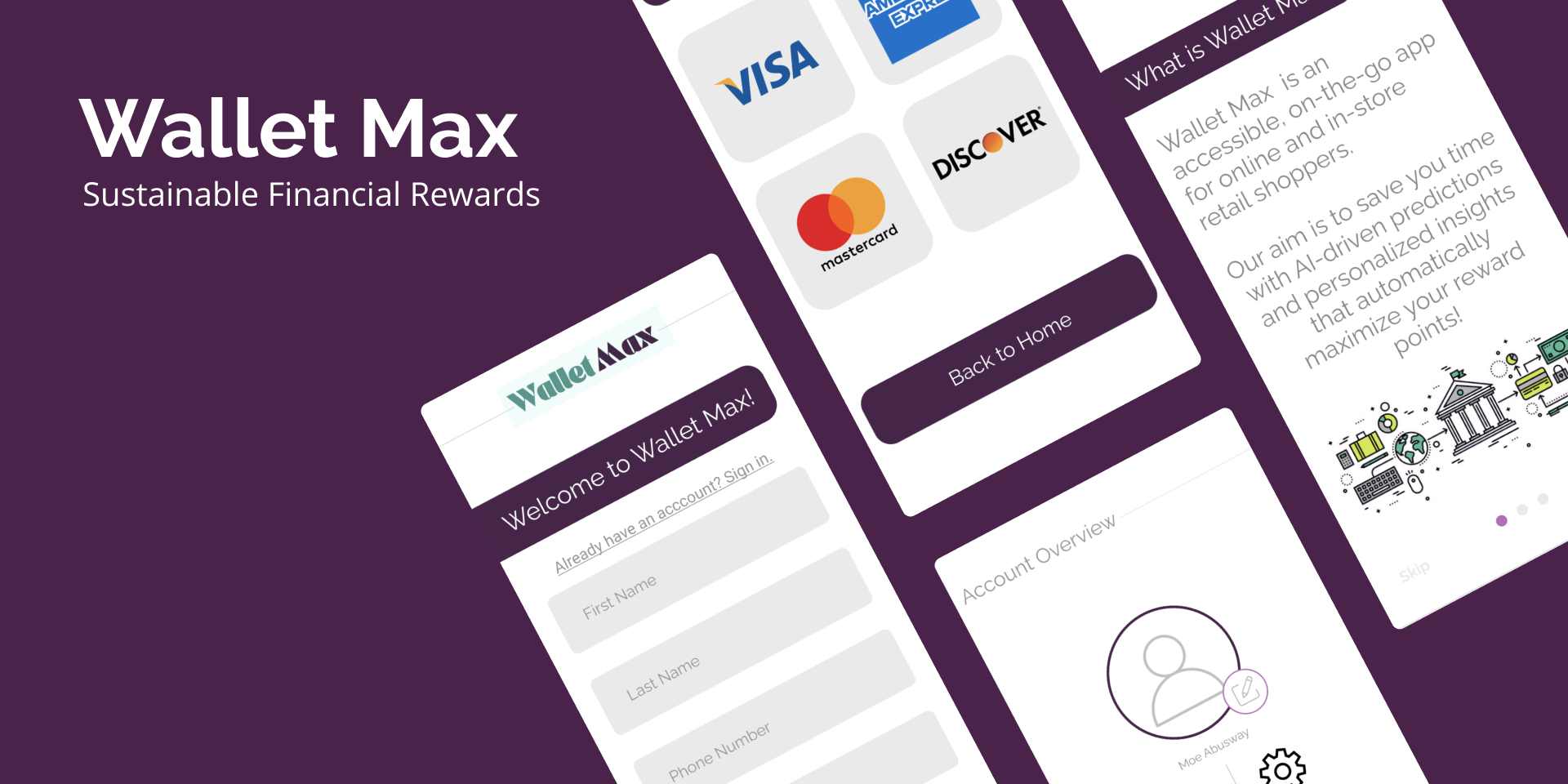

Wallet Max is a customer-driven, personal finance solution aimed at maximizing the money that comes back to consumers through personalized credit card offers, company rewards programs, and other cash-back offerings. Wallet Max's goal is to save consumers' time with AI-driven predictions and personalized insights that automatically maximize their reward points. The first sprint had various structured goals including, but not limited to mobile app and webpage plugin prototyping, brand identity restructuring, design system creation, and social media marketing campaigns.

-

Project Duration

Projected Launch Date: April 1, 2022

1st Sprint: September 2021 to December 2021

2nd Sprint: January 2022 to April 2022

Advisors

Bhuva Subram, Founder + CEO of Wallet Max

Caitlin Everett, Wallet Max Design Advisor & Digital Product Designer and Strategist at Augintel

My Role

As a UX Design Intern at Wallet Max, I have been responsible for many aspects of the product’s development. Beginning in September, I began with researching who Wallet Max users might be and formulating their customer journeys, as well as investigating the current state of the mobile app. With the knowledge in mind, I began to prototype the Wallet Max mobile app as I would like to experience it, while also starting to ideate the incorporation of our AI Use Cases that Wallet Max’s backend engineering team had finalized. After meeting and comparing prototypes, we shifted our efforts to competitor research and analysis to see what we would need to push ourselves past other personal finance applications. From that point, until today, I have focused my efforts in recreating Wallet Max’s brand identity through collaboration with the marketing team. Once our design presence is finalized, I’ll shift focus back to creating prototypes with this new identity and will begin to work with the engineering team to decide on final interaction design elements.

-

Brand Identity

When I joined Wallet Max, there was an existing logo and color palette, but we hoped to strengthen the brand identity. The preliminary step to this process was researching colors and color use in the specific context of FinTech platforms. After this research, we moved onto iterating logos with our new colors and typography. Through multiple iterations of logos, colors, typography, and copy, the team was able to land on a final identity that felt authentic to the brand.

App Interface 2.0

An MVP for Wallet Max had already been created and tested when I joined, so we were able to dig right into pulling insights from the initial user testing in order to create a 2nd version of the app. This involved creating higher-fidelity prototypes that incorporated our newly curated brand identity. The priority of prototypes were as follows:

Onboarding Process

In deciding how users would be onboarded into Wallet Max, we understood that we must find a balance between explaining our capabilities and figuring out what the user wants to get out of using our app. By providing a brief description about Wallet Max’s mission and prompting first-time users to share aspects their spending habits and financial circumstances, we were able to gain the trust of our users and simultaneously, inform them of how useful our platform could be for them.

Landing Page

Unsure of what users would want to see first, we created several versions of the landing page to see what made the most sense. Ultimately, we learned that users felt a sense of privacy invasion when prompted to enter their card information upon first landing into the app. On the flip side, when not shown the option to “add a card” and “start saving” users were confused what they were supposed to do after onboarding. We arrived at a page that gives users the option to enter their card information, but also lets them explore the ways in which they can save through an example card and purchase.

After these aspects of the prototype were complete, we moved onto incorporating the developed brand identity into the rest of the platform and smoothing out some of the existing interactions. By January, we were looking to have a complete 2nd prototype that solidifies all of these asks.

-

Territory

Personal banking amongst Americans: We all struggle to track deals from multiple cards, through different apps or websites. Because of this, around 100B of cash back rewards are unclaimed in the U.S. alone. So, we created a platform that proactively gathers personalized offers, matching them with your "on-the-go" lifestyle, all in one digital wallet.

Supporting Statistics

According to a survey from Bankrate, 55% of rewards card holders who pay their bills in full each month are missing out on rewards by choosing debit or cash.

Shoppers have literally earned billions of dollars by shopping via cashback portals. Rakuten (formerly ebates) reports having paid out more than $1 billion in cash back to its 12 million members. That’s roughly $83 per member. Ibotta, another cash back portal, report having paid out more than $627 million to more than 35 million members. That’s about $18 per member in cash back. Lastly, Swagbucks, a similar cashback site, notes having paid out more than $383 million to its 10 million members. That’s about $38 per member.